Our assurance services include Statutory audit, Tax audit, Special audits and Investigations. Our Assurance assignments are conducted in accordance with the engagement standards issued by the ICAI. Our Audit Methodology is based on the Auditing Standards issued by the ICAI which are converged with the International Auditing Standards. As part of such audit assignments, we assess the adequacy of internal controls and our audit findings also reflect suggestions for improvement of such controls. We also assist in conversion of accounts in accordance with IFRS/ Ind-AS. We offer the following Assurance services:

The objective such audit is to critically review the operations at various levels of the management to ensure flawless process and effective control.

The firm has experience in conducting special audits entities which are funded by multilateral agencies.

The firm provides services as required under the Income tax Act 1961.

This consists of opinions on accounting and auditing matters in respect of applicability and interpretation of accounting standards issued by ICAI/ notified by Central Government and in relation to auditing standards and requirement of corporate laws in connection with statutory audit.

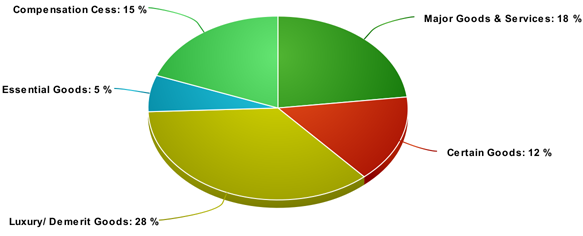

We have a team of professionals who are specialized in the field of GST and provide expert services related to GST.

Our GST team develops a thorough understanding of the emerging issues of GST and their impact on the client's businesses.

Tax practice is focused on finding opportunities and innovating methodology and leveraging them to the advantage of clients

in the form of solutions to complex tax issues coupled with significant tax savings.

Tax plays an important part in the entire operations of an organisation as well as an individual. We understand the importance of tax and therefore we provide a full range of services in the field of tax to assist you. Be it compliance, litigation or advisory, we are well equipped to handle critical tax issues in today’s tax environment. Our team is a blend of young and dynamic chartered accountants and partners who specialize in tax and the team is assisted by a retired member of the Appellate Tribunal.

We assist clients in enhancing risk management; improving performance and operating efficiency while providing the foundation to achieve better business performance. We work to build internal audit into a strategic and productive tool in today's corporate governance environment and simultaneously strive to advise our clients regarding strategic and operational risks. We serve clients in diverse industries such as Manufacturing, Trading, Information Technology, Healthcare, Insurance, Media & Entertainment, Credit Rating Agencies, Aviation, Textiles, Automotive, Healthcare, Non-Banking Financial Institutions, FMCG, ITES, Infrastructure, Non-Profit Organizations, Engineering, Pharma, Power Generation Service etc.

We leverage our tax and audit expertise across various industries to provide sound professional advice to support companies in their growth strategies. Be it JV formation, an acquisition or a valuation assignment, our advice is objective and our communication is free from jargon. Our TSS services include:

Many a times lack of proper documentation or record can prove to be very costly for a company. Our outsourced secretarial services ensure that companies comply with all legal requirements relating to the Companies Act and the Foreign Exchange Management Act (FEMA) so that the companies are always on the right side of the law. Our services include:

Competence and experience enables us to offer a wide range of Outsourcing Solutions to our clients, helping them to manage heavy workloads. Taking peace of mind as an ideal, we offer an efficient helping hand to our clients.

In short, you are in control of your activities in India without having to be here. Receive statements, reports, accounts and any other information daily.

We offer many other services; get in touch to find out more

We offer a wide array of highly reliable BPO outsourcing services, which include accounting business process outsourcing, fixed assets register, physical verification services and many more.

Application Filing Service

As part of our BPO Service Range, we offer credible Application Filing Service for PAN and TAN No. Our PAN & TAN No. Application Filing Service is very popular among our clients because of the professional approach with which we offer them. We also provide customized solutions to our clients for filling service for TAN and PAN Applications.

We stand as a well-known provider of Financial Accounting services in India. Reliable, efficacious and prompt are the best features of our financial accounting outsourcing services.

As part of our BPO Services, we offer credible Fixed Assets Register Service, which is very popular among our clients because of our professional approach. In India it is mandatory for the companies to maintain a Fixed Assets Register of all its assets in a minimum prescribed format.

As part of our BPO Services, we offer credible Import Export Registration Service, which covers major aspects of any type of Import Export Transaction.

We have achieved expertise in providing Payroll Processing to our clients. We provide an innovative solution that drives more values from our clients. The payroll processing outsourcing services that we provide are of a high standard. We take a holistic and end to end approach that has made us one of the leading payroll services in India.

With our emphasis on performance improvements and focused business insight, we excel in providing outstanding Physical Verification services. We provide timely services of physical verification of stocks.

We also provide ecstatic services for employees Provident Fund. With timely execution and complete responsibility, we provide excellent employment provident fund services in India. As per Provident Fund Act, every establishment whose number of employees exceeds the specified minimum number of employees and below whose salary is below the specified amount will have to deduct at a specified rate mentioned in the Act and deposit the same along with the employer share which is equivalent to the amount deducted from the employee’s salary.

Nowadays most of the big organizations are taking the help of the professional firms in preparing their operational procedural manual to achieve their vital objective to utilize the available resources in an optimum manner. We also offer similar services to our esteemed clients.